Life Insurance in and around Post Falls

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Post Falls, Idaho

- Coeur d Alene, Idaho

- Rathdrum, Idaho

- Spirit Lake, Idaho

- Hayden, Idaho

- Old Town, Idaho

- Priest River, Idaho

- Athol, Idaho

State Farm Offers Life Insurance Options, Too

Can you guess the price of a typical funeral? Most people aren't aware that the common cost of a funeral in this day and age is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If those closest to you cannot meet that need, they may experience financial hardship after your passing. With a life insurance policy from State Farm, your family can thrive, even without your income. Whether it pays for college, keeps paying for your home or pays off debts, the life insurance you choose can be there when it’s needed most by your loved ones.

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Life Insurance You Can Trust

And State Farm Agent Sue Breesnee is ready to help design a policy to meet you specific needs, whether you want level or flexible payments with coverage designed to last a lifetime or coverage for a specific time frame. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

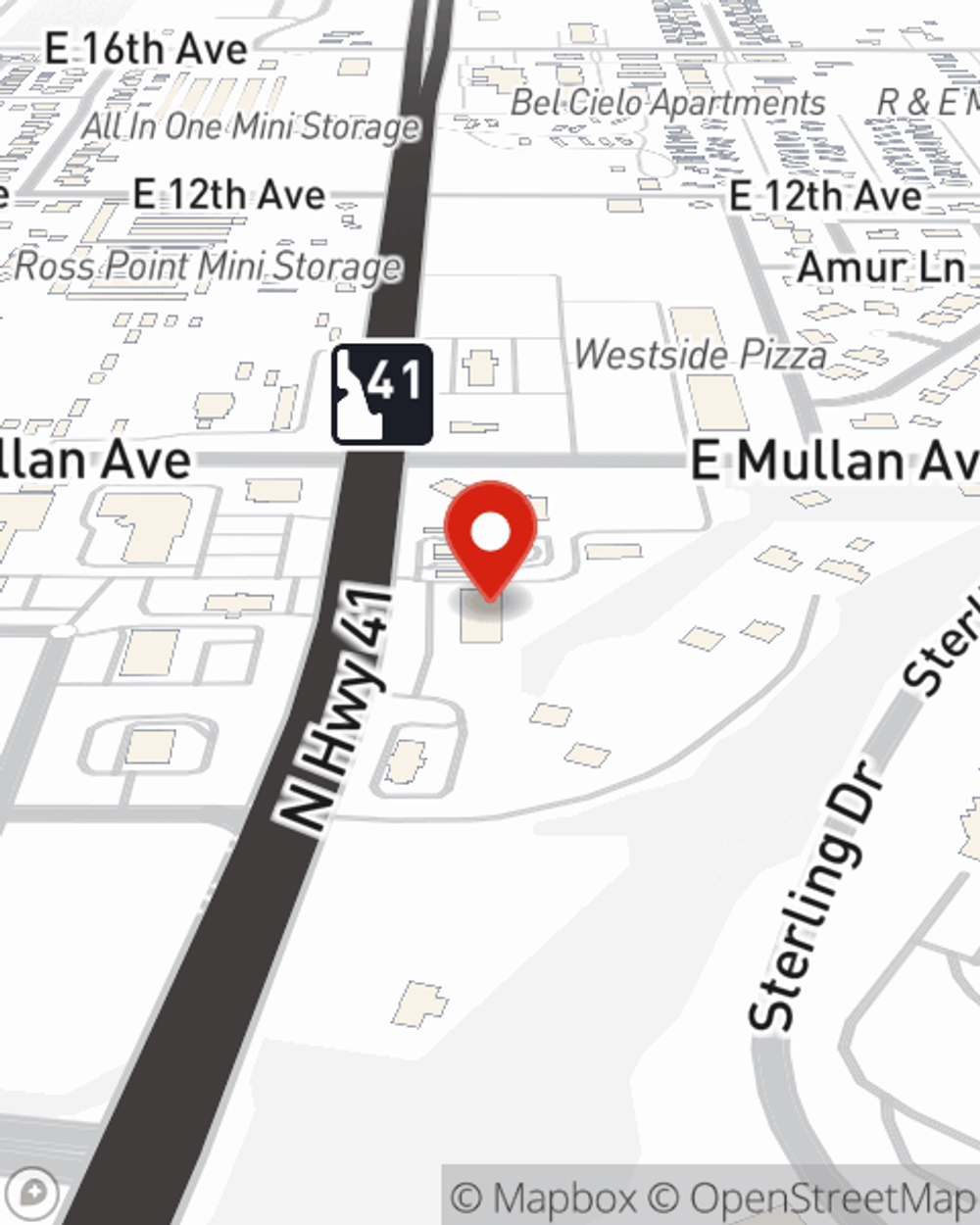

Simply get in touch with State Farm agent Sue Breesnee's office today to learn more about how a company that processes nearly forty thousand claims each day can help protect your loved ones.

Have More Questions About Life Insurance?

Call Sue at (208) 457-9000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Sue Breesnee

State Farm® Insurance AgentSimple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.